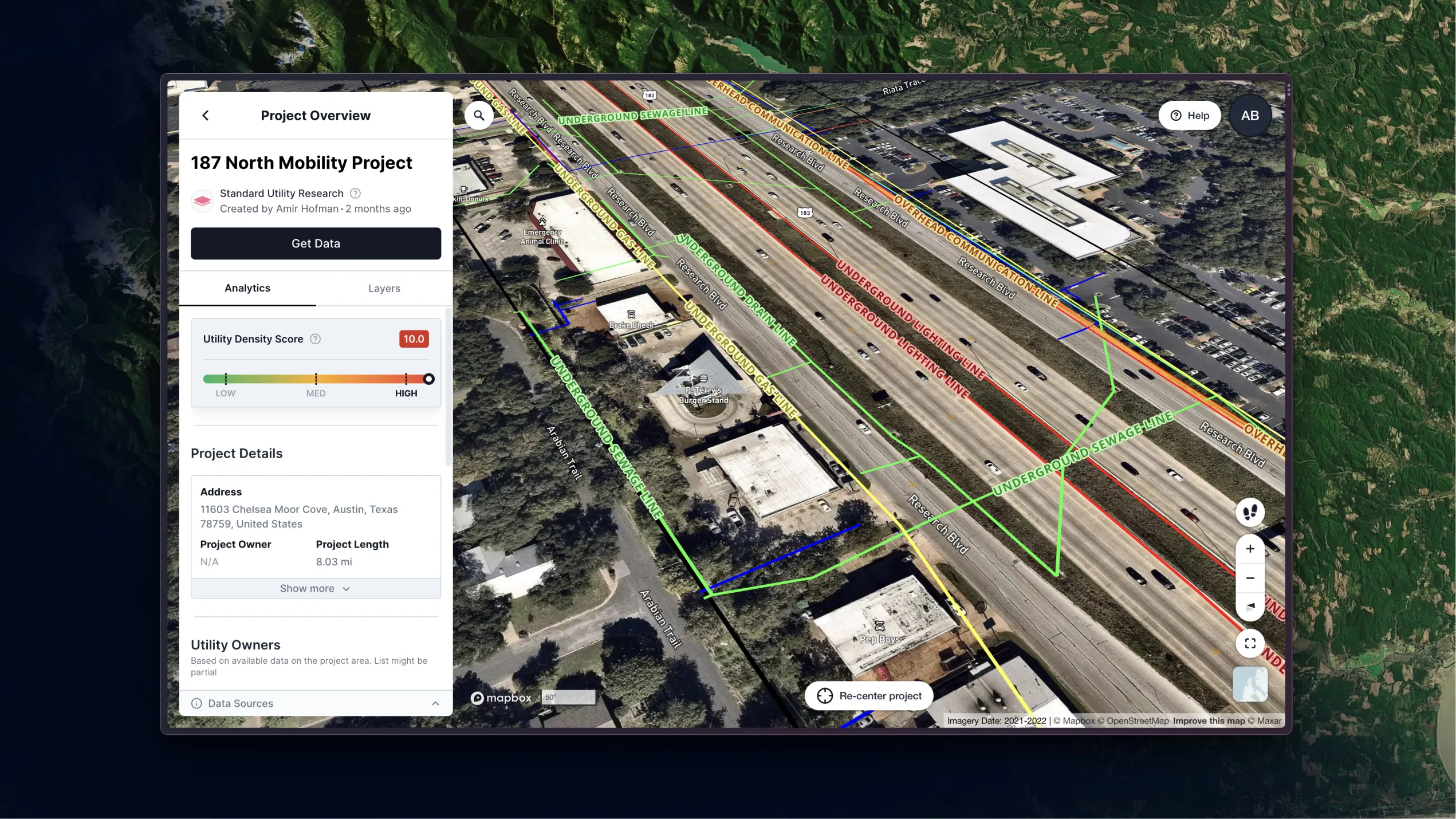

The ultimate source of utility data

Start utility risk mitigation and coordination as early as pre-design. Without leaving the office. Without leaving your desk.

.svg)

What is a Utility Survey?

TL;DR:

- A utility survey assesses underground utilities on construction sites to avoid hazards and damages.

- It is essential for risk mitigation and compliance with legal regulations.

- Various methodologies like Utility AI Mapping, EM locators, GPR, acoustic methods, and vacuum excavation are used for utility surveys.

- Utility surveys are crucial in industries like construction, infrastructure development, and urban planning.

- Investing in a utility survey during the early stages of infrastructure development is essential for successful and safe construction projects.

What is a utility survey?

A utility survey is a comprehensive assessment of underground utilities and structures within a given area — usually a construction site. Often conducted by Subsurface Utility Engineering (SUE) professionals, a utility survey includes the location, depth, and type of utilities present, helping teams avoid hazards and damages as they break ground on a building project.

The first phase of any utility survey is a desk study — record research that looks at utility maps, as-builts, and other existing information to create a preliminary view of utilities in the project area. (This step just got easier with the introduction of 4M's Preliminary Real-Time Data, an AI-powered solution for record research.) From there, utility locators take the preliminary data and conduct field investigations to verify the presence and location of utilities.

Utility surveys are critical components of construction projects. They provide valuable insights into the underground environment and help mitigate risks. When they leverage advanced technologies and methodologies, surveyors can accurately map underground utilities, ensuring worker safety and the integrity of existing infrastructure.

Investing in a utility survey is not just a smart business decision — it's a necessary step toward a successful, sustainable construction project.

Importance in risk mitigation

Conducting a utility survey — ideally during the earliest phases of project planning, when it's most cost-effective and can deliver the highest value — is essential to mitigating risks on a construction site. When teams know the location of existing underground infrastructure, they can avoid accidental damage during excavation and drilling — and the liability associated with those risks.

Creating a utility survey before breaking ground on a construction project is not optional, but you can use a combination of approaches and methods to achieve this.

"Use all appropriate means to figure out where utilities are," says Jim Anspach, P.G., Dist.M.ASCE, NAC, in a recent webinar. "At points where you need really good data, you might have to dig it up and look at it. In between, you've got records, professional judgment, common sense, and geophysics to give you an idea of what's there."

Utility survey methodologies

A utility survey often includes data from several sources. Here are a few examples of methodologies for collecting utility survey data:

Electromagnetic (EM) locators

EM locators find buried pipes and cables by picking up their electromagnetic signals. There are different methods for various situations:

- Direct connection (most accurate): A current is applied directly to an exposed metal part of the target line (for example, a fire hydrant) for precise tracing. Direct connection requires accessible metal and only works for metallic lines.

- Ring clamp (less accurate): The ring clamp method can be used when direct access isn't available. A clamp induces a signal onto the line for tracing. It's a good choice for midpoints and non-disruptive tracing of cable TV or internet lines.

- Induction (works best with few other lines): The transmitter sends a signal to locate the line without direct contact. This method can be tricky if there are many underground metallic lines nearby.

Ground-penetrating radar (GPR)

Ground Penetrating Radar (GPR) uses radar to detect the presence of underground utility lines. It works by sending short bursts of electromagnetic energy into the ground. These pulses travel through soil and bounce back when they hit objects like pipes and cables. The way the signal bounces back depends on the material it hits. GPR can interpret these "echoes" to create an image of what's buried, including depth information. Because the pulses can travel through many materials, GPR is a great tool for finding not just metal pipes but also non-metallic ones like PVC, plastic, and concrete.

Acoustic methods

EM locators and ground-penetrating radar (GPR) are excellent tools, but they don't work perfectly in every situation. That's where acoustic methods come in. These techniques use specially designed sound waves sent into the ground. By measuring how long it takes these sound waves to bounce back, operators can figure out how deep things are buried. This method works well in conditions like asphalt, sandy soil, or wet ground, where GPR might struggle.

Vacuum excavation

Sometimes utility locators need to get to the utility line itself. For those cases, a vacuum excavation technique uses specialized equipment to shoot a burst of air or water into the ground, carefully loosening the soil around the pipe or cable. Then, a powerful vacuum sucks up the loose dirt, creating a clear path to access the line without any damage.

Legal and regulatory compliance

Compliance with legal and regulatory requirements is another crucial aspect of utility surveys. Many countries have strict guidelines in place to ensure the safety of underground utilities and prevent damage to public infrastructure. A few examples include:

- One Call / 811 (Call Before You Dig) in the United States

- Health and Safety Executive (HSE) Guidelines in the United Kingdom

- Essential Services Code in Australia

When they conduct a thorough utility survey, construction teams demonstrate their commitment to compliance and avoid potential legal issues.

Industry applications and new technologies

Utility surveys are essential in various industries, including construction, infrastructure development, and urban planning. Creating a reliable utility survey helps to streamline project timelines, reduce costs, and minimize disruptions to existing infrastructure. From residential developments to large-scale infrastructure projects, utility surveys play a vital role in ensuring the success and safety of construction endeavors.

Labor shortages in engineering and construction, coupled with a need to build more projects with less money, have created a capacity problem for the construction industry. Technology plays an increasingly important role in solving that capacity problem by disrupting human-intensive utility risk mitigation practices. The president and CEO of Autodesk, Andrew Anagnost, emphasizes this point on Episode 34 of the Digital Builder podcast.

The New Era of Utility Surveys

Engineers often spend 40–80 hours on utility records research for a single highway mile. With today's complex subsurface challenges and growing demand for new projects, traditional utility survey methods are no longer sustainable.

It's time for a new era of utility surveys powered by new technologies, such as utility AI mapping solutions, that streamline utility record research and data gathering, cut costs, save time, and allow utility stakeholders to focus on more strategic tasks.

"Technology is enabling us to do a much better job of collecting [utility] data and checking its reliability, accuracy, and comprehensiveness," says Anspach. From advanced geophysics to Bluetooth, advances in software for multi-channel GPR, and data mining techniques, all of that technology is making getting records and preparing records for future use a lot easier."

At 4M, our vision is not just about modernizing utility mapping methods —it's about unlocking access to the world below us, ensuring the continuity and development of all critical infrastructure and services people rely on daily. We are at a pivotal moment where digital transformation can and should redefine the utility infrastructure industry, including the process of creating a utility survey.